As a digital nomad or frequent traveler, having reliable travel insurance is essential. Unexpected situations—such as medical emergencies, trip cancellations, or lost luggage—can disrupt your travel plans and become costly setbacks. Goose Travel Insurance has gained attention recently for its affordable and flexible coverage, making it a strong contender for travelers seeking peace of mind. But is it the right choice for you?

What Is Goose Travel Insurance?

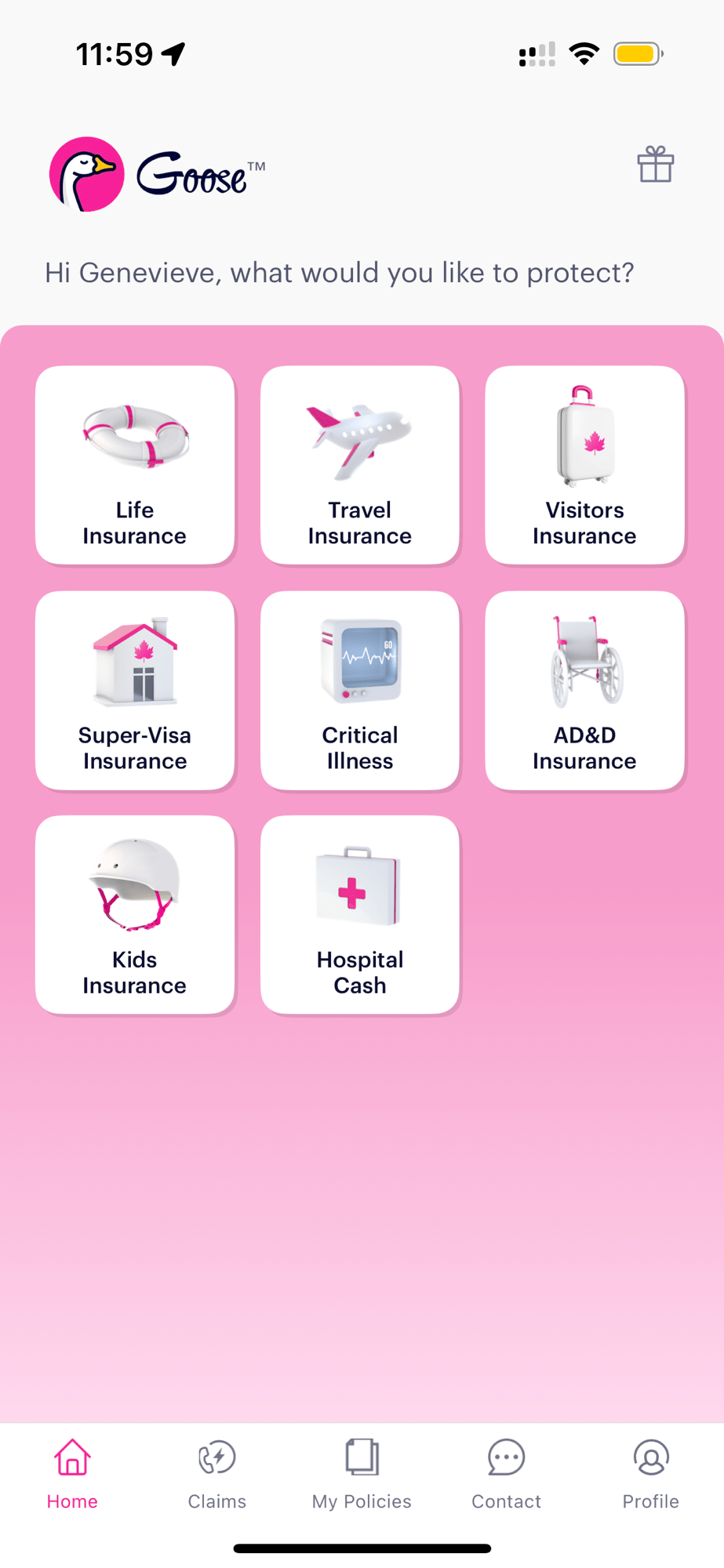

Goose Insurance is a digital-first insurance provider offering travel insurance, critical illness insurance, and life insurance. It operates primarily in Canada and the United States, focusing on simplifying the insurance process through a mobile app. With instant quotes, easy policy management, and competitive pricing, Goose appeals to travelers looking for hassle-free protection.

Key Features of Goose Travel Insurance

1. Comprehensive Medical Coverage

One of the standout features of Goose Travel Insurance is its extensive medical coverage. It includes:

• Emergency medical expenses (hospitalization, doctor visits, prescriptions)

• Coverage for COVID-19-related medical expenses

• Emergency evacuation and repatriation

• Accidental death and dismemberment coverage

For digital nomads and frequent travelers, having robust health coverage is crucial, especially when visiting countries with expensive healthcare systems.

2. Trip Cancellation and Interruption

Goose offers trip protection benefits, covering costs if you need to cancel or cut short your trip due to unforeseen circumstances such as:

• Illness or injury

• Death of a family member

• Travel advisories or emergencies in your destination

This feature ensures you don’t lose money on non-refundable bookings.

3. Lost, Stolen, or Delayed Baggage

Losing your luggage can be a nightmare, especially when traveling with essential items like electronics, cameras, and vegan-friendly snacks. Goose provides compensation for lost, stolen, or delayed baggage, allowing you to replace your belongings with minimal financial stress.

4. Flexible and Affordable Plans

Unlike traditional insurers, Goose offers flexibility with short-term and annual coverage plans, making it ideal for long-term travelers and weekend adventurers alike. Pricing is competitive, with lower costs than many traditional travel insurance providers.

5. Easy Mobile App Management

Goose’s mobile app makes it easy to:

• Get instant insurance quotes

• Purchase coverage in minutes

• Access policy details

• File claims directly through the app

This level of convenience is perfect for travelers constantly on the move.

Eco-Consciousness

Goose is a fully digital insurance company, reducing paper waste. While it does not market itself as an eco-conscious brand, its digital-first approach supports sustainability.

Who Should Choose Goose Travel Insurance?

✅ Best for:

• Digital nomads who need flexible coverage

• Budget-conscious travelers looking for affordable insurance

• Frequent flyers who need multi-trip coverage

• Canadians and Americans looking for simple, app-based insurance

❌ Not ideal for:

• Travelers seeking extensive adventure sports coverage

• Those requiring pre-existing condition coverage without limitations

• Non-North American residents (since Goose mainly operates in Canada and the U.S.)

How Much Does Goose Travel Insurance Cost?

Pricing varies based on factors like trip duration, destination, and age. However, Goose is known for offering lower rates compared to larger insurance providers. The best way to determine the cost is to get a quote via their mobile app.

How to Get Goose Travel Insurance

1. Download the Goose Insurance App (available for iOS and Android).

2. Enter your trip details (dates, destination, traveler info).

3. Receive an instant quote and customize your coverage.

4. Purchase the plan and access policy documents in the app.

Final Verdict: Is Goose Travel Insurance Worth It?

For digital nomads, frequent travelers, and those seeking an easy-to-manage insurance option, Goose Travel Insurance offers solid coverage at an affordable price. Its mobile-first approach makes it convenient, while its comprehensive medical coverage provides peace of mind.

However, if you’re planning high-risk activities or need specialized coverage, you may need to compare options. Overall, Goose is a strong choice for budget-friendly and flexible travel insurance.

Have you tried Goose Travel Insurance? Share your experience in the comments!

Leave a comment